Understanding Repossessed Mini Excavators

Introduction to Repossessed Mini Excavators

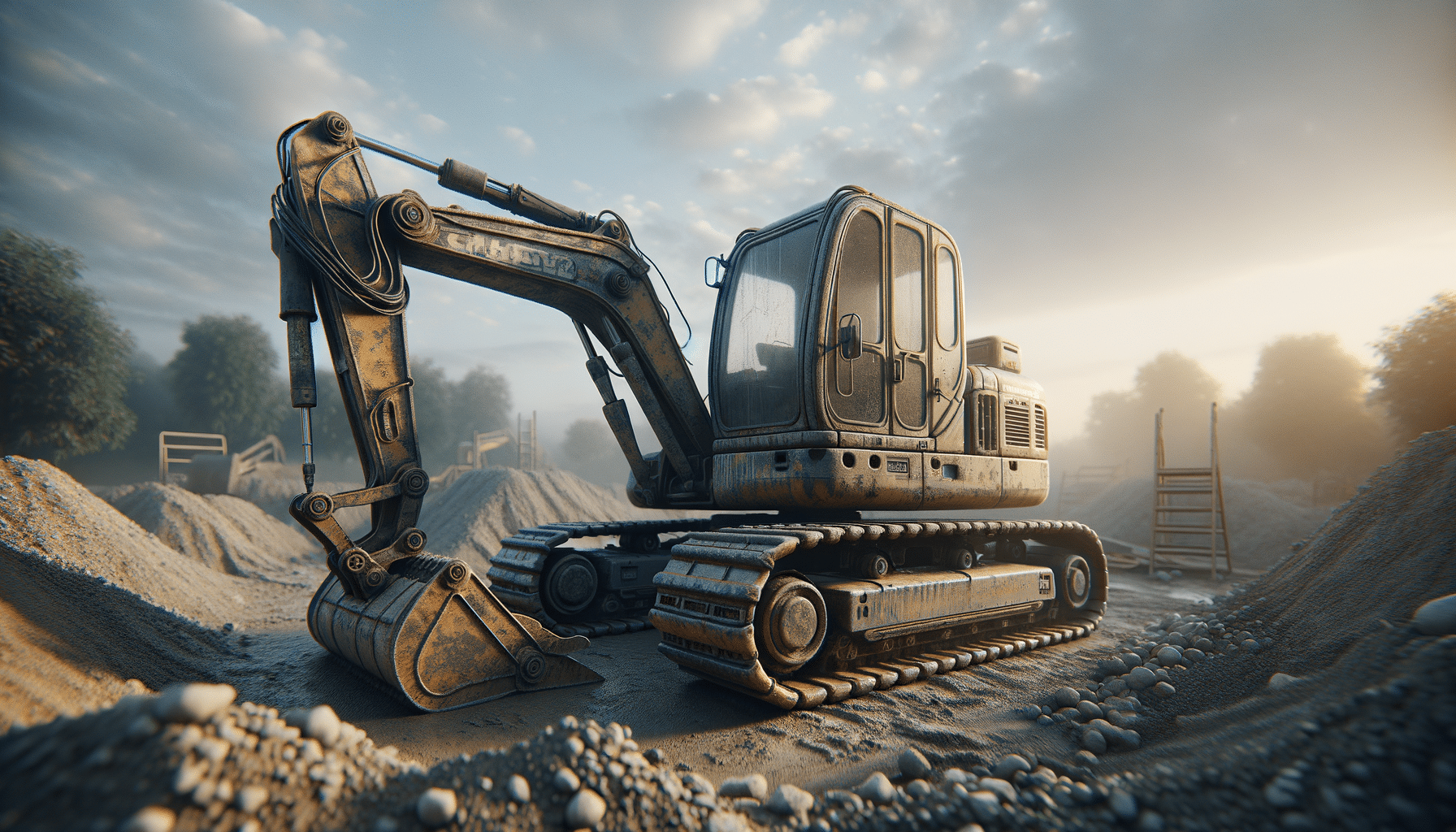

In the dynamic world of construction, equipment plays a pivotal role in shaping the efficiency and productivity of a project. Among the variety of machinery available, mini excavators stand out for their versatility and efficiency in handling smaller tasks. However, acquiring new equipment can be financially daunting. This is where repossessed mini excavators come into play, offering a cost-effective solution for construction companies and contractors.

Repossessed equipment refers to machinery that has been reclaimed by financial institutions due to non-payment from the original buyer. These mini excavators are then sold at auctions or through dealerships at reduced prices, providing an opportunity for businesses to acquire high-quality machinery without the hefty price tag. Understanding the nuances of purchasing repossessed mini excavators can open doors to significant savings and enhanced operational efficiency.

The Benefits of Choosing Repossessed Mini Excavators

Opting for repossessed mini excavators can be a strategic decision for several reasons. Firstly, the cost savings are substantial. New mini excavators can be quite expensive, but repossessed units are typically sold at a fraction of the original price. This allows businesses to allocate funds to other critical areas, such as training or additional equipment.

Moreover, repossessed mini excavators often come with a documented service history, allowing potential buyers to assess their condition accurately. This transparency helps in making informed purchasing decisions. Many financial institutions ensure that these machines are well-maintained to fetch a better price at resale, which means buyers can expect reliable performance.

- Cost-effectiveness: Repossessed units are significantly cheaper than new ones.

- Documented service history: Provides insight into maintenance and usage.

- Immediate availability: Unlike new machinery, repossessed equipment is ready for use.

In addition to these benefits, repossessed mini excavators also contribute to sustainability by extending the lifecycle of machinery, reducing the demand for new production.

Challenges and Considerations in Purchasing Repossessed Mini Excavators

While the advantages of repossessed mini excavators are clear, potential buyers must also consider certain challenges. One of the primary concerns is the condition of the equipment. Despite having a service history, there might be hidden issues that are not immediately apparent. Conducting a thorough inspection or hiring a professional to evaluate the machinery can mitigate this risk.

Another consideration is the availability of warranties. Repossessed equipment may not come with the same warranty protections as new units, leaving buyers responsible for future repairs. It’s crucial to factor in potential maintenance costs when budgeting for a repossessed mini excavator.

- Equipment condition: Ensure thorough inspection to identify potential issues.

- Lack of warranties: Consider potential repair costs.

- Limited selection: Availability depends on repossession rates and auction schedules.

Despite these challenges, with careful planning and due diligence, purchasing repossessed mini excavators can be a highly beneficial decision for many businesses.

How to Acquire Repossessed Mini Excavators

The process of acquiring repossessed mini excavators typically involves participating in auctions or working with dealerships that specialize in repossessed equipment. Auctions can be competitive, with many bidders vying for the same machinery. It’s essential to set a budget and stick to it to avoid overspending in the heat of the moment.

Dealerships, on the other hand, offer a more controlled environment where buyers can take their time to inspect the machinery and make informed decisions. These dealers often have a range of repossessed equipment, providing more options and the possibility of negotiating prices.

- Auctions: Be prepared for competitive bidding and set a strict budget.

- Dealerships: Offer a more relaxed purchasing environment with room for negotiation.

- Online platforms: Some auctions and dealers operate online, expanding access to repossessed equipment.

Whether choosing auctions or dealerships, it’s crucial to research thoroughly and understand the market value of the equipment to ensure a fair purchase.

Conclusion: Making the Right Choice for Your Business

Repossessed mini excavators present a compelling opportunity for construction businesses to enhance their capabilities while managing costs effectively. By understanding both the benefits and challenges associated with these machines, businesses can make informed decisions that align with their operational needs and financial goals.

Ultimately, the choice to invest in repossessed equipment should be guided by a thorough evaluation of the machinery’s condition, the reputation of the seller, and the potential return on investment. With careful consideration, repossessed mini excavators can become a valuable asset, driving productivity and efficiency in various construction projects.

In a market where every dollar counts, repossessed mini excavators offer a practical solution for businesses looking to expand their fleet without compromising on quality or performance.