Navigating the World of RV Takeover Payments: A Comprehensive Guide

Understanding RV Takeover Payments

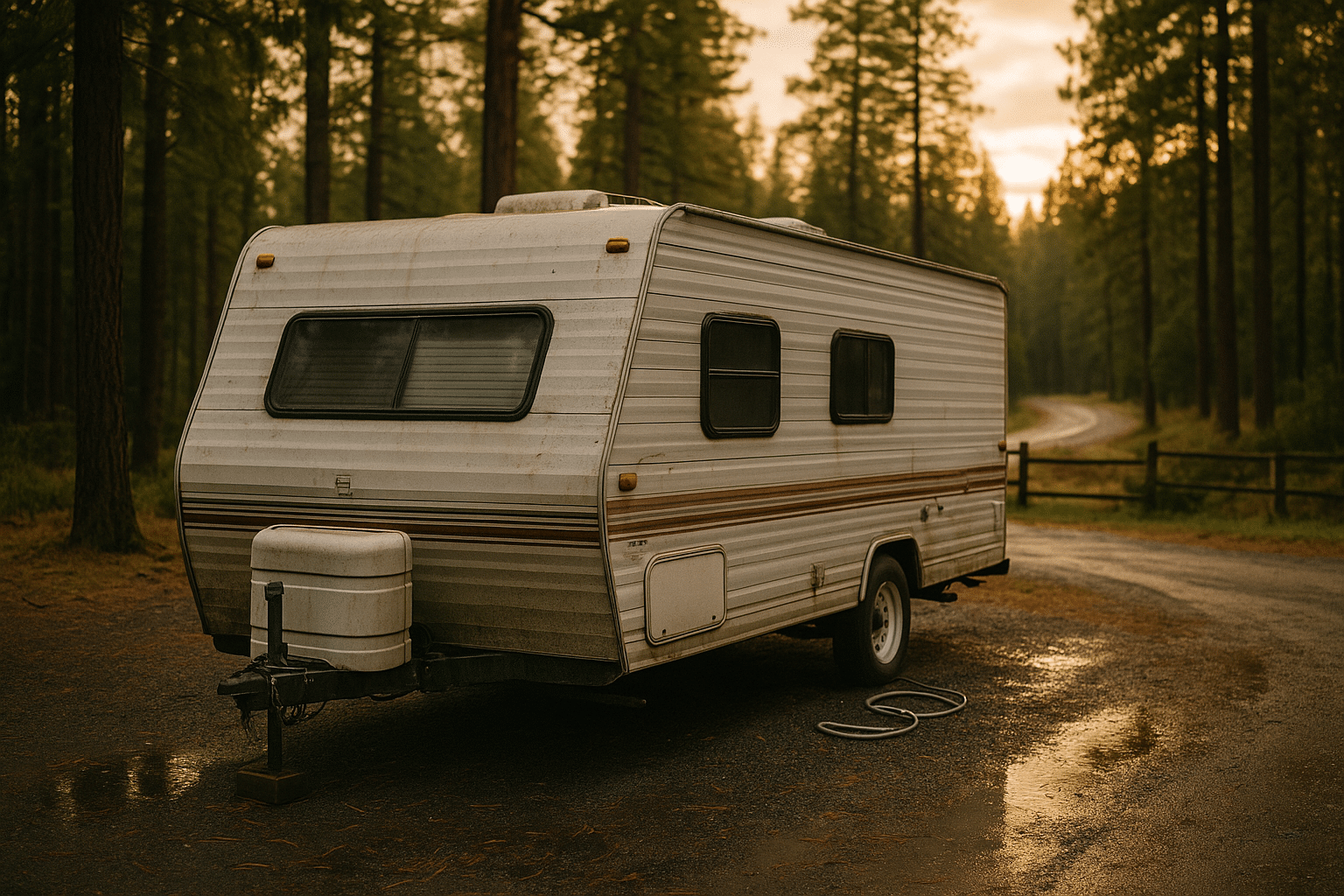

RV takeover payments offer a unique opportunity for individuals seeking to enter the world of recreational vehicles without the hefty initial cost of purchase. This arrangement allows a new buyer to assume the remaining payments of an RV loan, effectively “taking over” the financial responsibility from the current owner. This can be an attractive option for those who wish to enjoy the RV lifestyle but are unable or unwilling to commit to a full purchase price upfront.

In the realm of RV ownership, understanding the nuances of takeover payments is crucial. This financial arrangement is often seen as a win-win situation: the current owner can offload their RV without having to sell it outright, while the new buyer can enjoy the benefits of RV ownership with potentially lower upfront costs. However, this process is not without its complexities and requires careful consideration of various factors such as loan terms, interest rates, and the condition of the vehicle.

The process begins with the current owner and prospective buyer negotiating terms that are agreeable to both parties. This often involves a thorough examination of the existing loan agreement, including the interest rate and remaining balance. Additionally, potential buyers should assess the condition of the RV to ensure it meets their expectations and requirements. It’s also advisable to consult with a financial advisor or legal expert to fully understand the implications of assuming an existing loan.

Benefits of RV Takeover Payments

There are numerous benefits to opting for RV takeover payments, particularly for those who are new to the RV lifestyle or looking to upgrade their current vehicle. One of the most significant advantages is the reduced financial burden. By taking over an existing loan, buyers can avoid the large initial outlay associated with purchasing a new or used RV outright.

Another benefit is the potential to secure a better deal on an RV. Since the current owner is often motivated to transfer the loan to avoid further financial obligations, they may be willing to negotiate more favorable terms. This can include lower monthly payments or a reduced interest rate, making the overall cost of ownership more manageable.

Moreover, assuming an existing loan can provide a quicker path to RV ownership. Traditional purchasing processes can be lengthy, involving credit checks, negotiations, and often a significant waiting period. With takeover payments, the transition can be much swifter, allowing new owners to hit the road and start enjoying their RV adventures sooner.

- Reduced financial burden with lower initial costs

- Potentially favorable loan terms

- Quicker transition to RV ownership

Challenges and Considerations

While RV takeover payments offer many advantages, they also come with a set of challenges and considerations. One of the primary concerns is the financial stability and creditworthiness of the new buyer. Since they will be assuming an existing loan, it’s essential to ensure that they can meet the payment obligations consistently.

Additionally, the condition of the RV is a critical factor. Potential buyers should conduct a thorough inspection to assess any wear and tear, mechanical issues, or necessary repairs. This step is crucial to avoid unforeseen expenses that could negate the financial benefits of taking over the loan.

Another consideration is the legal and financial implications of assuming a loan. It’s advisable to seek professional advice to understand the contractual obligations fully and ensure that the transfer of ownership is legally binding. This includes reviewing the loan agreement, understanding any penalties for early repayment, and ensuring that the lender approves the transfer.

- Financial stability and creditworthiness of the buyer

- Condition and maintenance history of the RV

- Legal and financial implications of assuming the loan

Steps to Successfully Navigate RV Takeover Payments

Successfully navigating RV takeover payments involves a series of strategic steps to ensure a smooth transition and avoid potential pitfalls. The first step is to establish clear communication with the current owner. This involves discussing the terms of the loan, the condition of the RV, and any additional costs that may arise.

Next, conducting a thorough inspection of the RV is imperative. This should include a comprehensive review of the vehicle’s maintenance history, any past repairs, and a detailed check of its current condition. Engaging a professional mechanic for this task can provide a more accurate assessment and peace of mind.

Once the inspection is complete, reviewing the loan agreement with a financial advisor is advisable. This ensures that all parties understand the terms and conditions, including any penalties or fees. It’s also crucial to obtain written approval from the lender for the loan transfer, solidifying the new ownership legally and financially.

- Establish clear communication with the current owner

- Conduct a thorough inspection of the RV

- Review the loan agreement with a financial advisor

- Obtain lender approval for the loan transfer

Conclusion: Is RV Takeover Payment Right for You?

Deciding whether RV takeover payments are the right option depends on individual circumstances and financial goals. For many, it presents an opportunity to enjoy the freedom and adventure of RV ownership without the immediate financial burden of a full purchase. However, it requires careful consideration of the vehicle’s condition, loan terms, and personal financial stability.

Ultimately, RV takeover payments can be a viable path to ownership for those willing to navigate the complexities and make informed decisions. By conducting thorough research, seeking professional advice, and ensuring clear communication with all parties involved, prospective RV owners can embark on their journeys with confidence and excitement.

As with any significant financial decision, weighing the pros and cons and aligning them with personal goals is essential. For those ready to embrace the RV lifestyle, takeover payments offer a flexible and potentially rewarding option to explore the open road.