Learn About Repossessed RVs: A Smart Buyer’s Guide

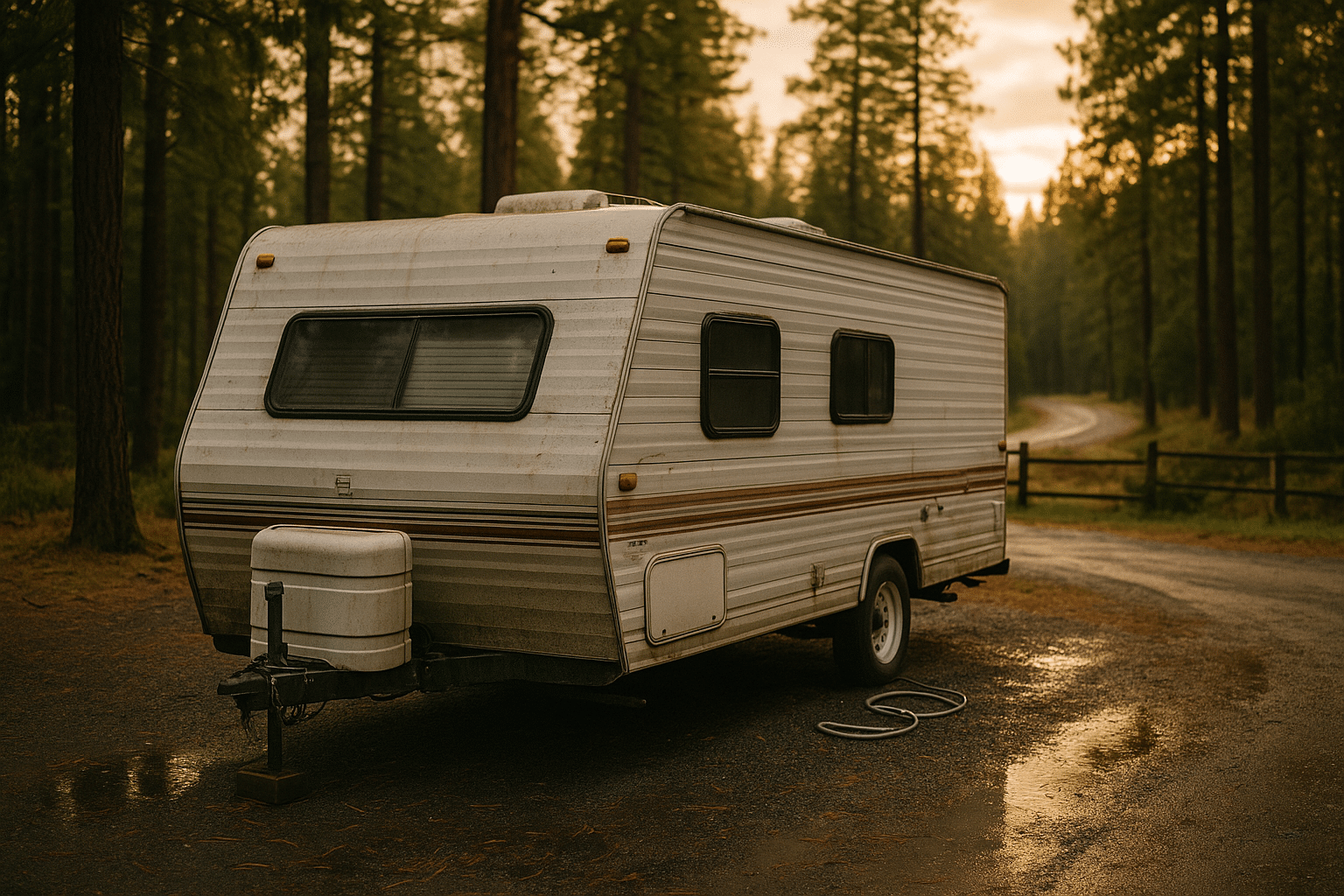

Introduction to Repossessed RVs

Repossessed RVs offer a unique opportunity for buyers looking to enter the world of recreational vehicles without the hefty price tag of a new model. These RVs, often taken back by lenders due to non-payment, can be found at significant discounts compared to their original price. Understanding the ins and outs of buying a repossessed RV is crucial to making a smart purchase. This guide will explore the benefits, potential challenges, and strategies for purchasing a repossessed RV, helping you navigate this niche market with confidence.

Benefits of Buying a Repossessed RV

One of the primary advantages of purchasing a repossessed RV is the cost savings. These vehicles are often sold at auctions or through dealerships at a fraction of their original price, making them an attractive option for budget-conscious buyers. Additionally, repossessed RVs may be relatively new, with some models only a few years old, offering modern amenities and features at a reduced cost.

Another benefit is the potential for customization. With the money saved on the initial purchase, buyers can invest in personalizing their RV to better suit their needs and preferences. This might include upgrades to the interior, adding technology features, or enhancing the vehicle’s exterior.

Furthermore, buying a repossessed RV can also mean less depreciation. New RVs can lose significant value within the first few years, but purchasing a used, repossessed model can mitigate this financial impact.

- Cost savings compared to new models

- Potential for customization

- Less depreciation over time

Challenges of Purchasing Repossessed RVs

While the financial benefits are appealing, buying a repossessed RV does come with its challenges. One of the most significant is the potential for hidden damage or needed repairs. Since these vehicles are often sold “as-is,” buyers must be prepared for the possibility of unforeseen issues. It is essential to conduct a thorough inspection or hire a professional to assess the RV’s condition before purchasing.

Another challenge is the limited availability of specific models or features. Repossessed RVs may not always come with the exact specifications a buyer desires, requiring flexibility and a willingness to compromise on certain aspects.

Additionally, the process of purchasing a repossessed RV can be complex. Auctions can be competitive, and the paperwork involved in acquiring a repossessed vehicle can be more complicated than buying a new or traditionally used RV.

- Potential for hidden damage or repairs

- Limited model availability

- Complex purchasing process

Where to Find Repossessed RVs

Locating repossessed RVs can be a rewarding endeavor if you know where to look. Auctions are a popular venue for these vehicles, with both physical and online auctions available. Websites specializing in RV sales often list repossessed models, providing a convenient way to browse available options from the comfort of your home.

Dealerships are another resource, as they sometimes acquire repossessed RVs to sell alongside their new and used inventory. Visiting local dealerships and inquiring about their stock can yield promising results.

Additionally, some lenders and financial institutions sell repossessed RVs directly. Contacting banks or credit unions can lead to opportunities to purchase these vehicles before they reach auction.

- Physical and online auctions

- Dealerships with repossessed stock

- Direct sales from lenders

Tips for Buying Repossessed RVs

When considering a repossessed RV, preparation is key. Start by setting a budget and determining what features are most important to you. Research different models and their typical market values to ensure you are getting a fair deal.

Conducting a thorough inspection is crucial. Look for signs of wear and tear, check for any mechanical issues, and verify the condition of the RV’s interior and exterior. If possible, hire a professional inspector to provide an unbiased assessment of the vehicle’s condition.

Finally, be prepared for the auction process if you choose to bid. Understand the rules and terms of the auction, and have a clear maximum bid in mind to avoid overpaying in the heat of the moment.

- Set a clear budget and prioritize features

- Conduct thorough inspections or hire a professional

- Be prepared for the auction process

Conclusion: Making the Right Choice

Purchasing a repossessed RV can be a savvy investment for those willing to do their homework and approach the process with caution. By understanding the benefits and challenges, knowing where to find these vehicles, and following key buying tips, you can secure a high-quality RV at a fraction of the cost of a new model. Whether you’re a first-time buyer or an experienced RV enthusiast, repossessed RVs offer an opportunity to embrace the open road without breaking the bank.