Understanding Rent To Own Houses – A Comprehensive Guide

Introduction to Rent-To-Own Housing

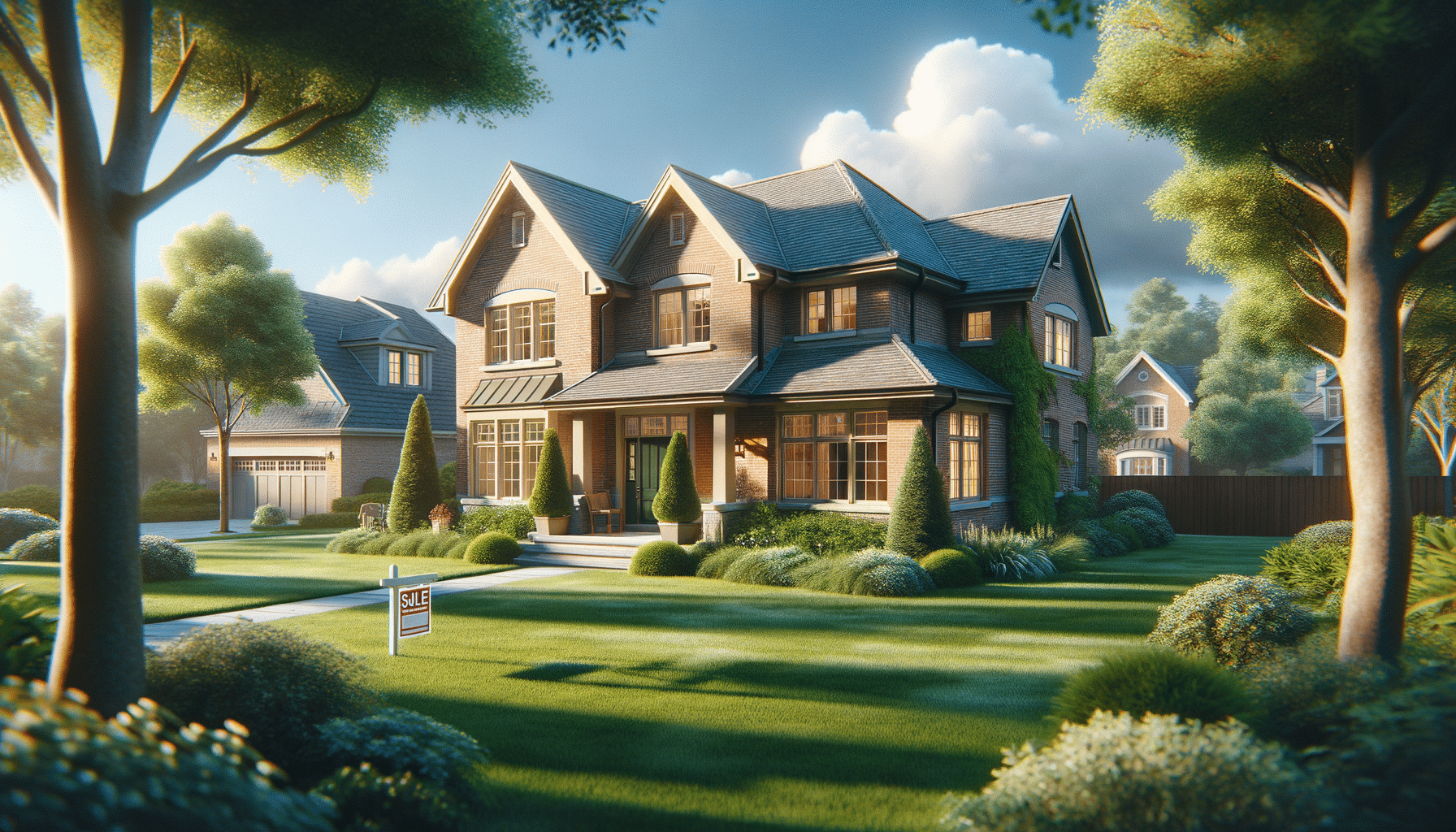

In the journey towards homeownership, the rent-to-own option presents a unique pathway that combines renting with the opportunity to purchase a home. This arrangement is increasingly gaining popularity among individuals who may not qualify for a traditional mortgage or those looking to test living in a property before committing to a purchase. Understanding rent-to-own houses is crucial for anyone considering this route, as it involves distinct contractual agreements and financial implications.

Rent-to-own agreements typically involve a lease agreement with an option to purchase the property at a later date. This arrangement allows tenants to live in the property as renters while saving towards a down payment and improving their credit score. During the rental period, a portion of the monthly rent is often set aside as a credit towards the eventual purchase of the home.

The concept is appealing for several reasons: it provides a sense of stability, allows tenants to lock in a purchase price, and offers the flexibility to walk away if circumstances change. However, potential buyers need to be aware of the terms and conditions, as well as the potential risks involved.

How Rent-To-Own Agreements Work

Rent-to-own agreements are structured in two main components: a standard lease agreement and an option to purchase. The lease agreement outlines the rental terms, such as the monthly rent, duration of the lease, and maintenance responsibilities. Typically, these agreements last between one to three years, allowing tenants to build their financial standing.

The option to purchase is a separate agreement that gives the tenant the right, but not the obligation, to buy the property at a predetermined price. This price is usually agreed upon at the start of the lease and remains fixed throughout the rental period. To secure this option, tenants may be required to pay a non-refundable option fee, which can range from 1% to 5% of the purchase price.

During the rental period, a portion of the rent payment may be allocated towards the purchase price, effectively acting as a forced savings plan. This rent credit can be an attractive feature, but it’s essential to understand that it may not significantly reduce the purchase price.

It’s crucial for tenants to conduct thorough research and seek legal advice before entering a rent-to-own agreement. Understanding the terms, such as the option fee, rent credits, and maintenance responsibilities, will help in making an informed decision.

Advantages of Rent-To-Own Homes

Rent-to-own homes offer several advantages that make them appealing to potential buyers. First and foremost, they provide a pathway to homeownership for individuals who may not qualify for a traditional mortgage. By allowing tenants to improve their credit score and save for a down payment over time, rent-to-own agreements offer a gradual transition into homeownership.

Another significant advantage is the ability to lock in a purchase price at the start of the lease. This can be particularly beneficial in a rising housing market, as tenants are protected from future price increases. Additionally, living in the property during the lease period allows tenants to familiarize themselves with the home and the neighborhood, reducing the risk of buyer’s remorse.

Rent-to-own agreements also offer flexibility. If a tenant decides not to purchase the property, they can walk away at the end of the lease period, albeit forfeiting any option fee and rent credits. This flexibility can be advantageous for individuals whose circumstances may change, such as job relocation or financial difficulties.

Overall, the rent-to-own option can be a viable solution for those looking to transition from renting to owning, provided they understand the terms and are committed to the process.

Challenges and Risks of Rent-To-Own Agreements

While rent-to-own arrangements offer a unique path to homeownership, they also come with challenges and risks that potential buyers must consider. One of the primary risks is the loss of the option fee and rent credits if the tenant decides not to purchase the property. These amounts are typically non-refundable, representing a financial loss if the purchase does not proceed.

Another challenge is the potential for unfavorable contract terms. Rent-to-own agreements can be complex, with terms that may heavily favor the seller. It’s crucial for tenants to carefully review and negotiate the contract, ideally with the assistance of a legal professional, to ensure fair and transparent terms.

Maintenance responsibilities can also pose a challenge. Unlike traditional rental agreements where landlords handle maintenance, rent-to-own contracts may place this responsibility on the tenant. This can lead to unexpected expenses that tenants need to be prepared for.

Lastly, market conditions can affect the viability of a rent-to-own agreement. If property values decline, tenants may find themselves locked into a purchase price higher than the market value, leading to potential financial strain.

Understanding these challenges and conducting due diligence is essential for anyone considering a rent-to-own agreement. Being aware of the risks will help tenants make informed decisions and navigate the process effectively.

Conclusion: Is Rent-To-Own Right for You?

Rent-to-own agreements offer a unique and flexible pathway to homeownership, particularly for individuals who may face challenges securing a traditional mortgage. By blending elements of renting and buying, this option provides an opportunity to transition into homeownership while enjoying the benefits of living in the property.

However, it’s essential to approach rent-to-own agreements with careful consideration. Understanding the terms, potential risks, and responsibilities involved is crucial for making an informed decision. Prospective buyers should conduct thorough research, seek professional advice, and evaluate their financial situation before entering into a rent-to-own agreement.

Ultimately, rent-to-own can be a valuable option for those committed to becoming homeowners, provided they are prepared for the challenges and willing to adhere to the terms of the agreement. By weighing the advantages and risks, individuals can determine if this pathway aligns with their homeownership goals and financial capabilities.